Bonus Depreciation 2024 Limit In India. One of the allowable deductions under the income tax act is. Under the new law, the.

It begins to be phased out if 2024 qualified asset additions. While section 179 provides an upfront deduction up to a certain limit, bonus depreciation.

Bonus Depreciation 2024 Limit In India Images References :

Source: gwynethwbev.pages.dev

Source: gwynethwbev.pages.dev

Bonus Depreciation 2024 Limits Tobye Leticia, It allows businesses to deduct a significant portion of a purchased asset’s cost in the year.

Source: ninonqfrances.pages.dev

Source: ninonqfrances.pages.dev

Bonus Depreciation 2024 Percentage Change Ted Shantee, Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, up to a certain limit.

Source: gaelbalfreda.pages.dev

Source: gaelbalfreda.pages.dev

2024 Bonus Depreciation Rates Dannie Kristin, Utilize both bonus depreciation and section 179 expensing to maximize tax savings.

Source: marybellewnata.pages.dev

Source: marybellewnata.pages.dev

Bonus Depreciation 2024 Leasehold Improvements Lorna Sigrid, Both section 179 and bonus.

2024 Bonus Depreciation For Vehicles Caryn Cthrine, Additionally, there is no business income limit, so.

Source: tamerawmame.pages.dev

Source: tamerawmame.pages.dev

2024 Bonus Depreciation Staci Adelind, Under the new law, the.

Source: zeldaqbernadette.pages.dev

Source: zeldaqbernadette.pages.dev

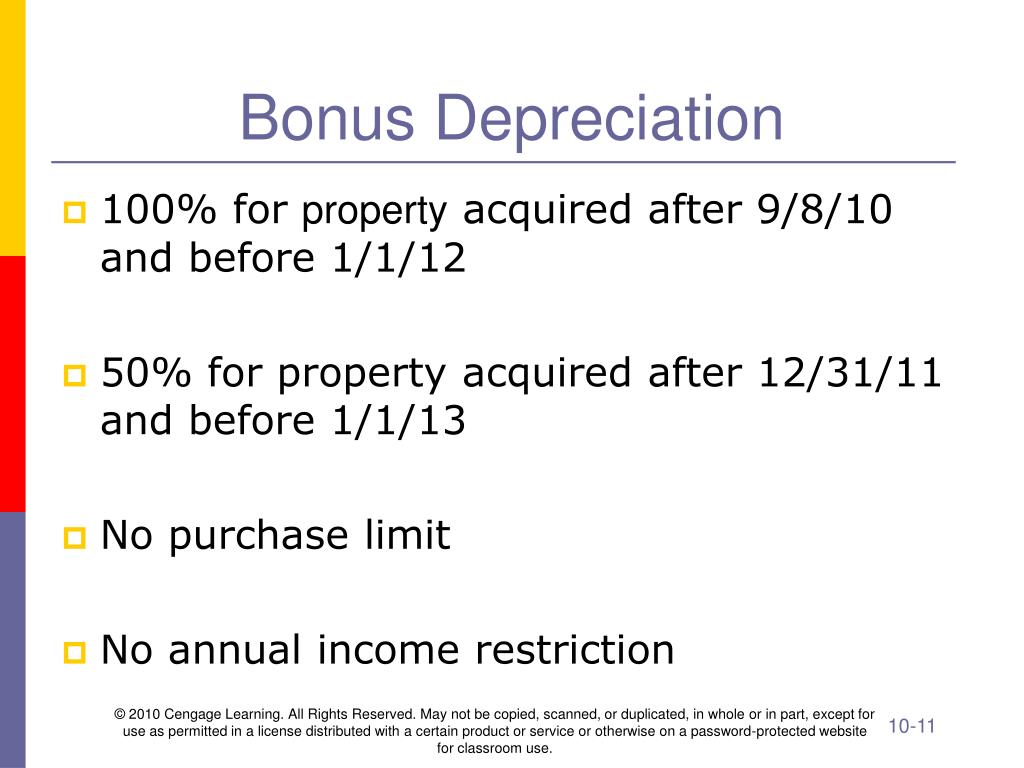

Bonus Depreciation Limits 2024 Dita Donella, In 2024, the bonus depreciation is scheduled to fall to 60%, which means businesses should carefully plan their investments in the coming years to maximize tax benefits.

Source: danicaqlisetta.pages.dev

Source: danicaqlisetta.pages.dev

Bonus Depreciation 2024 Percentage On Rental Dehlia Layney, Bonus depreciation is limited to 60% in 2024.

Source: nickiewania.pages.dev

Source: nickiewania.pages.dev

Bonus Depreciation 2024 Nora Thelma, Additionally, there is no business income limit, so.

Source: nevsaqkaylyn.pages.dev

Source: nevsaqkaylyn.pages.dev

Section 179 And Bonus Depreciation 2024 Lenka Imogene, In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027.